The Challenge

Banking Security Teams Are Under Constant Pressure

The Challenge

Banking Security Teams Are Under Constant Pressure

With a growing number of digital services, third-party integrations, and cloud infrastructure, financial institutions are under relentless pressure to protect sensitive data and meet strict regulatory standards.

But disjointed tools, massive scan volumes, and manual processes make it difficult to maintain full visibility, reduce risk, and respond to audits efficiently.

How Brinqa Helps

Business-Aligned Risk Management Built for Banking

Brinqa helps financial organizations:

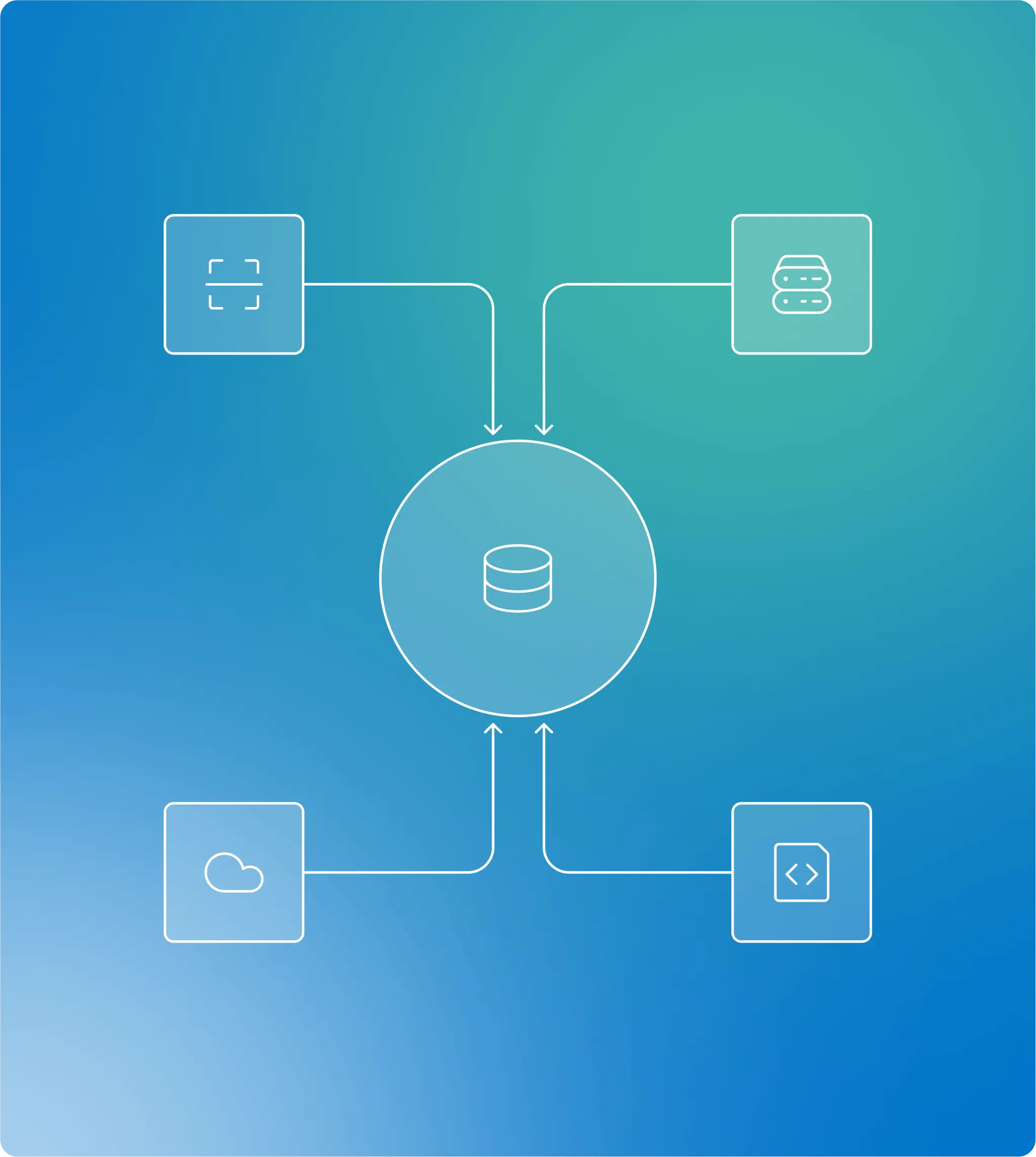

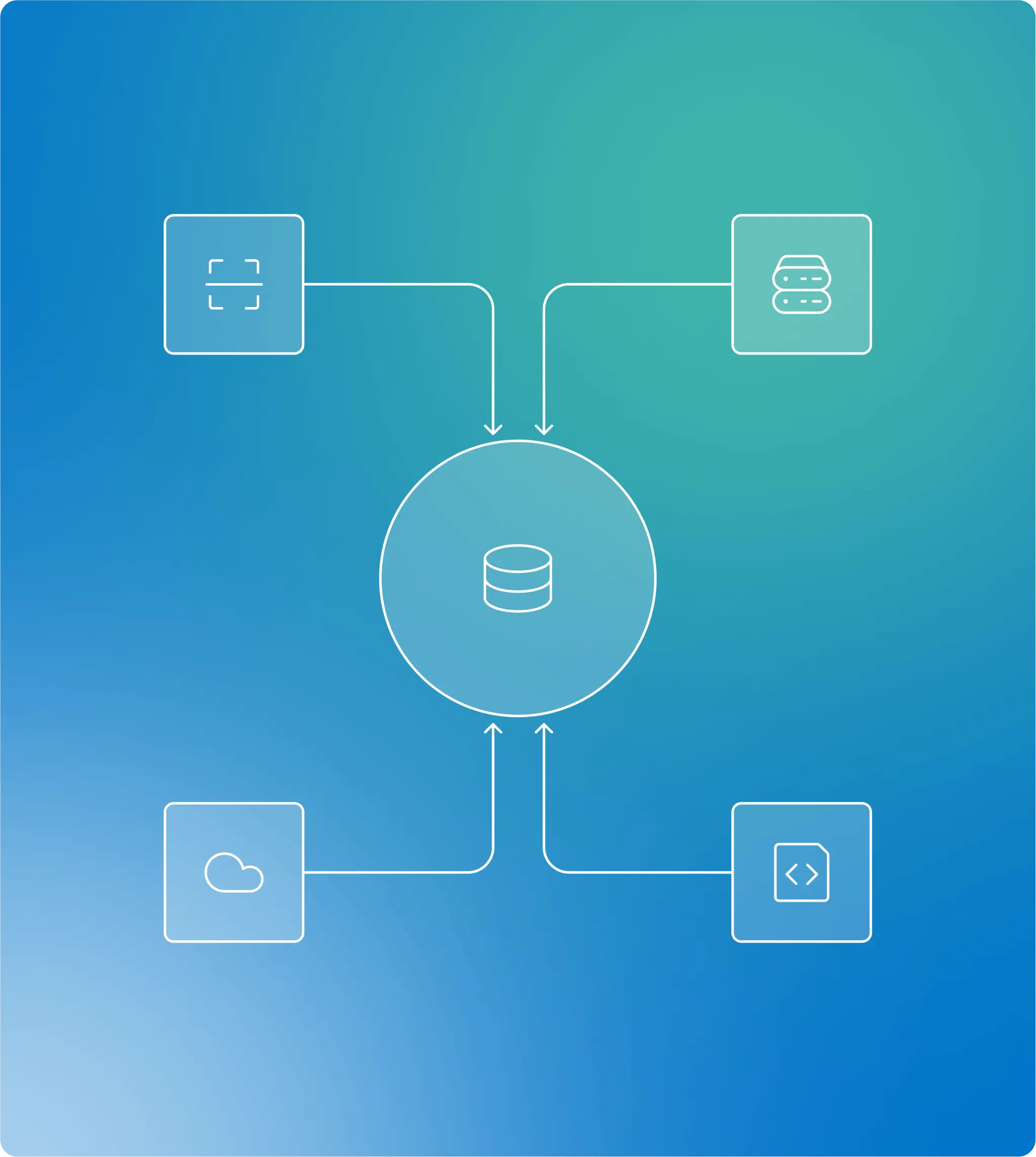

from scanners, CMDBs, cloud tools, and more

Why Brinqa

Key Capabilities for Financial Institutions

Compliance & Audit Alignment

Prove Banking Security and Compliance with Unified Risk Controls