The Challenge

Legacy Systems and Emerging Threats Collide

The Challenge

Legacy Systems and Emerging Threats Collide

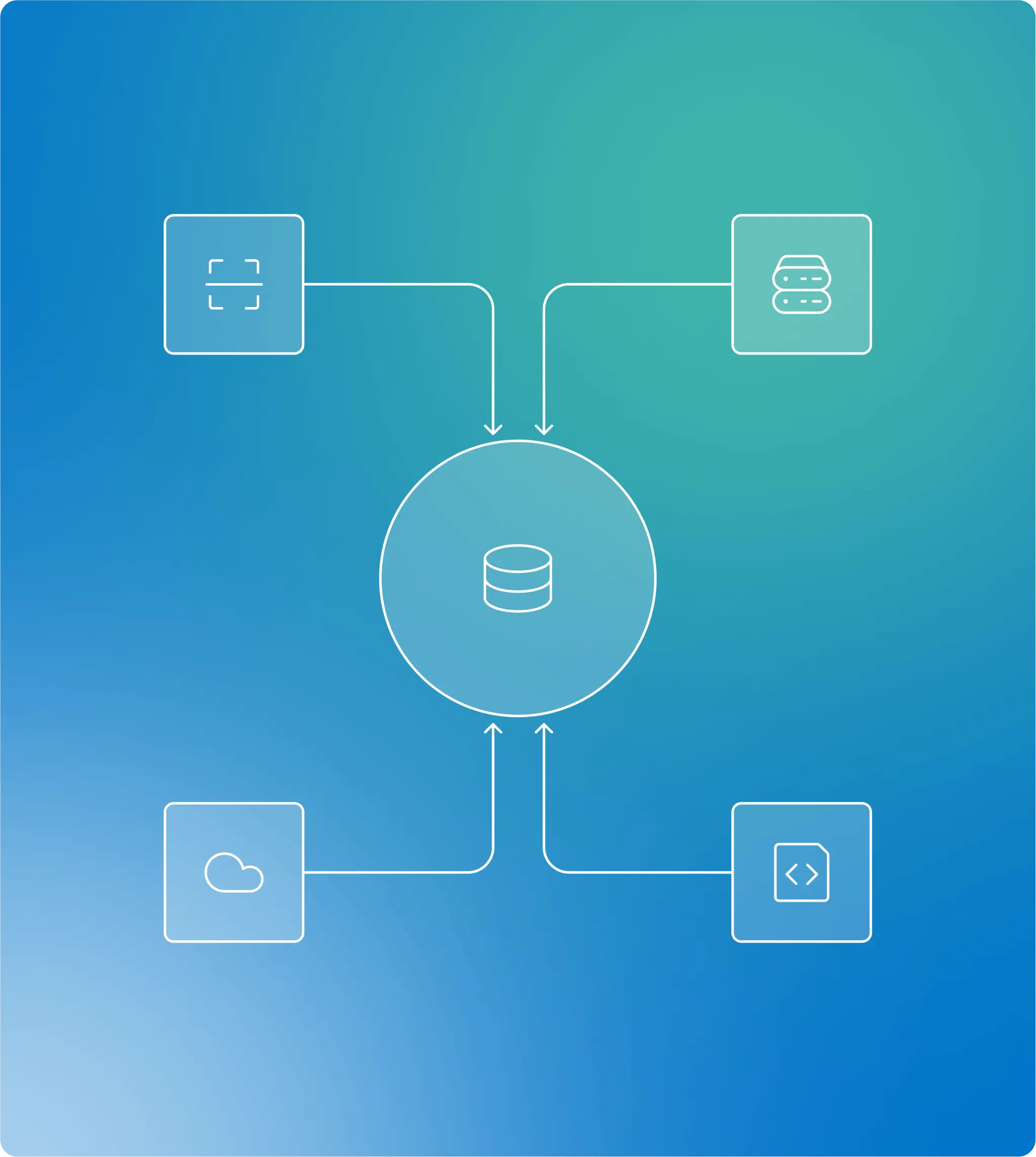

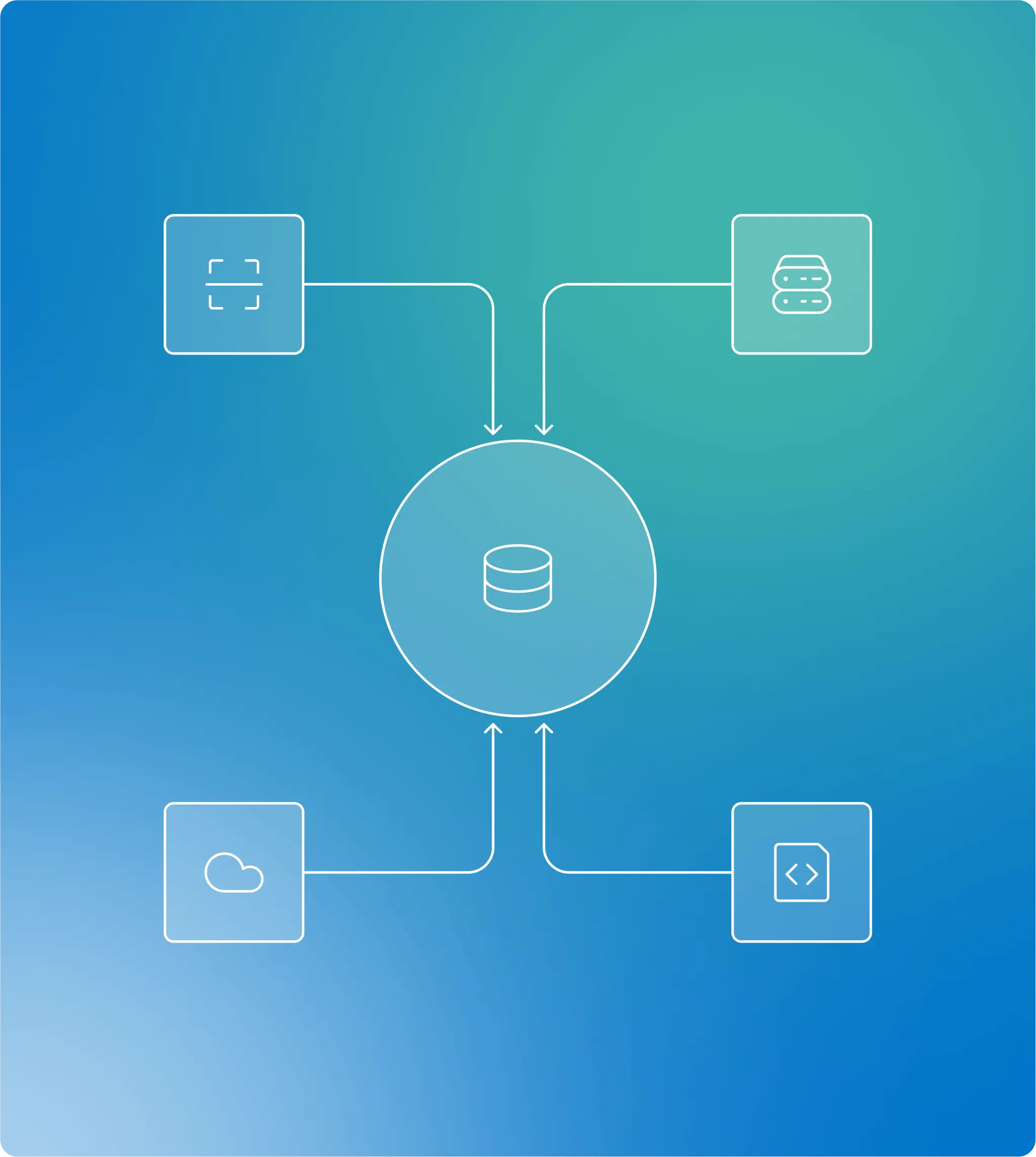

From mainframes to cloud-native apps, insurers manage some of the most diverse and risk-sensitive IT environments. Vulnerabilities span decades of infrastructure, and fragmented tools make it difficult to align remediation efforts with business impact.

Security and compliance teams need accurate visibility, automated workflows, and auditable reporting to stay ahead of growing risk and regulatory pressure.

How Brinqa Helps

Unify Risk Intelligence Across Old and New Systems

Brinqa helps financial services team:

from legacy and cloud systems

Why Brinqa

Key Capabilities for Insurers

Compliance & Audit Alignment

Protect Policyholder Trust with Proven Compliance Safeguards

Compliance Checklist

HIPAA Compliance Checklist