The Challenge

Cyber Risk and Regulatory Expectations Are Growing

The Challenge

Cyber Risk and Regulatory Expectations Are Growing

Finance organizations face increasing scrutiny from customers, partners, and regulators. With sprawling attack surfaces, evolving cyber threats, and growing volumes of vulnerability data, it’s harder than ever to reduce exposure and ensure compliance.

Manual risk triage and disjointed tools leave teams reactive and under pressure.

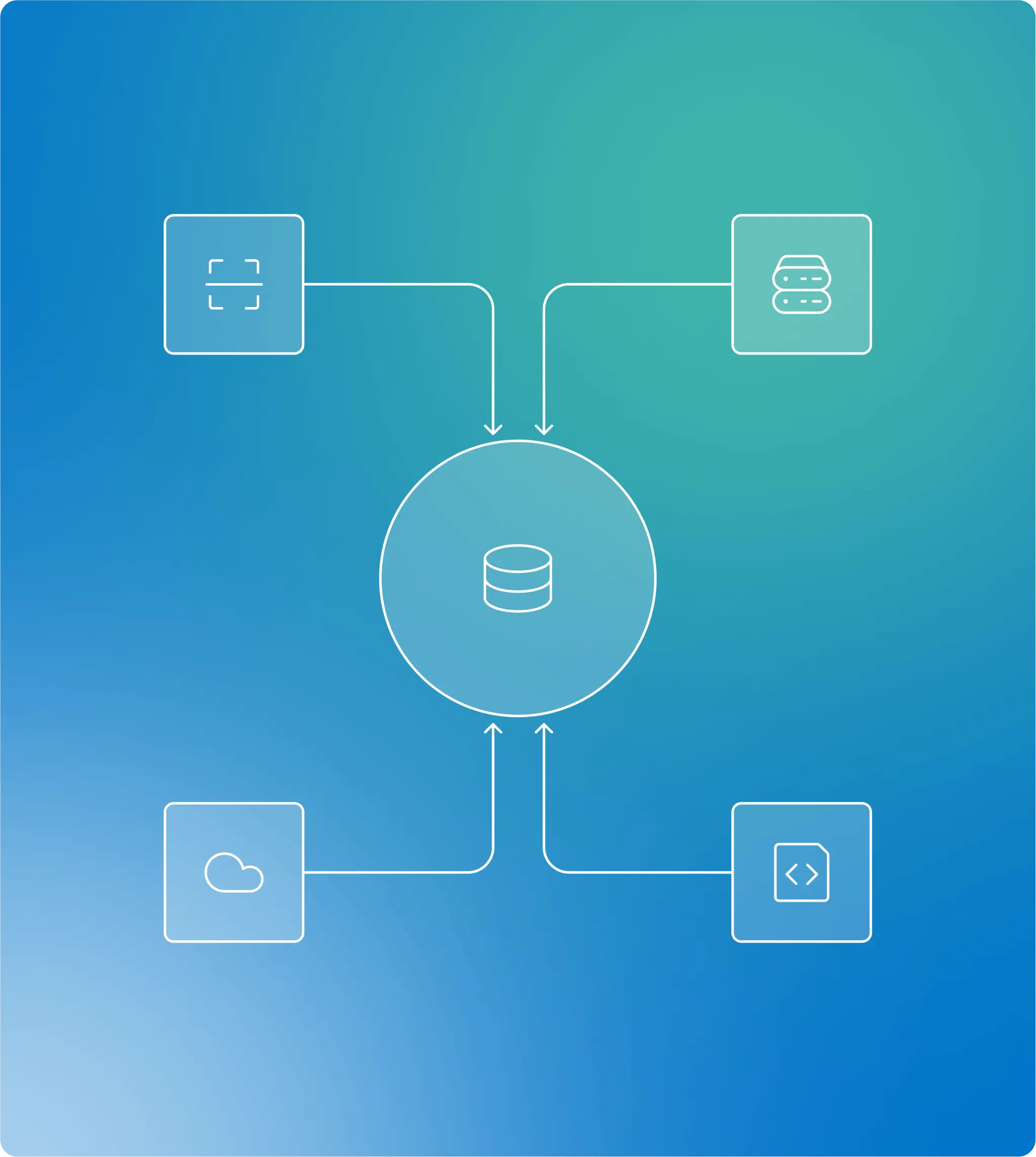

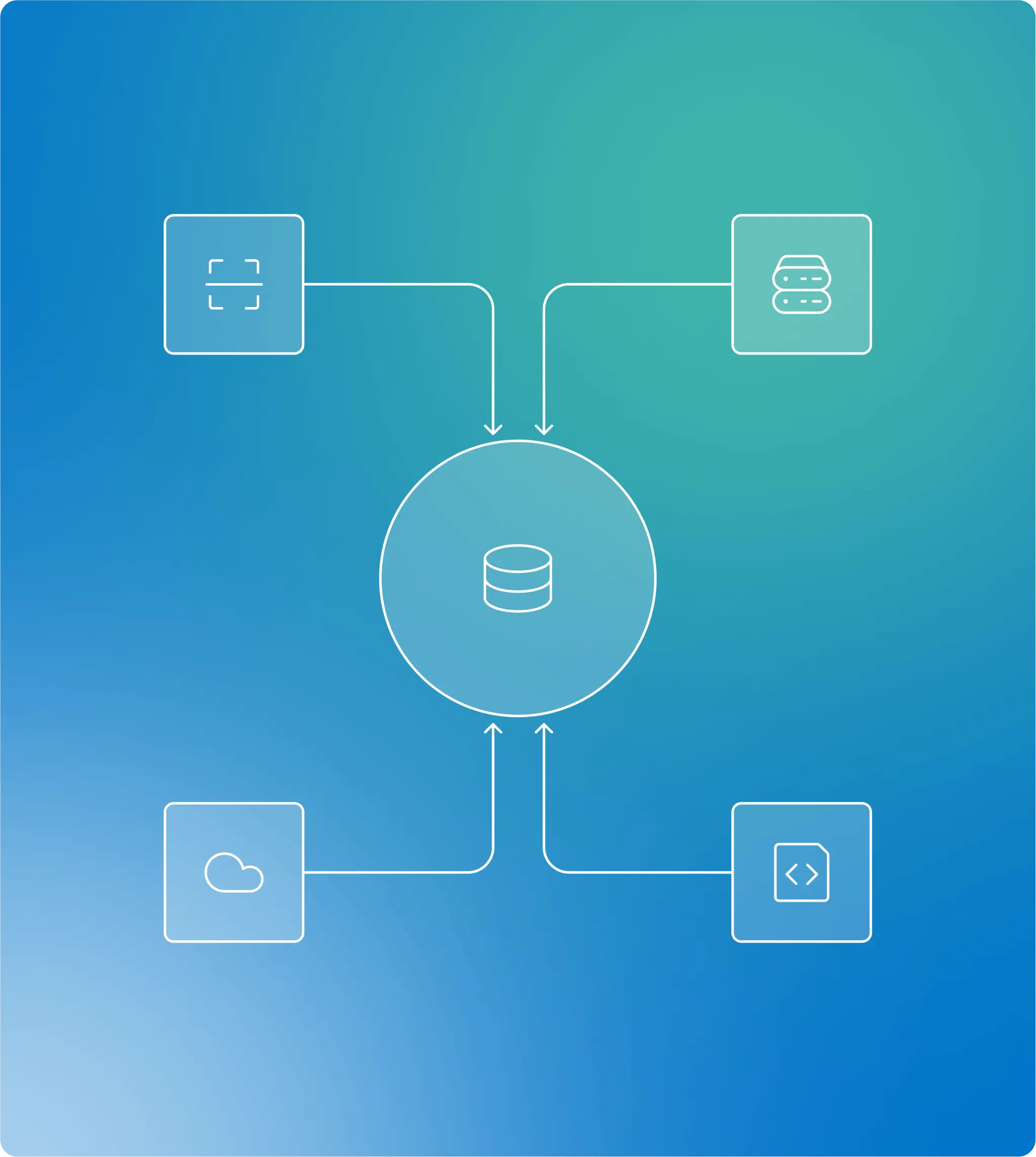

How Brinqa Helps

Operationalize Risk and Compliance Across the Stack

Brinqa helps financial services team:

from scanning tools, cloud platforms, and IT systems

Why Brinqa

Key Capabilities for Financial Institutions

Compliance & Audit Alignment

Strengthen Financial Resilience Through Risk-Based Compliance Assurance